Health insurance in the United States plays a critical role in protecting individuals and families from high medical costs. Healthcare services in the USA can be expensive, and without insurance, even a simple doctor visit or emergency treatment can lead to significant financial burden. Understanding how to apply for health insurance and knowing its benefits can help you make informed decisions for your health and finances.

The first step is understanding how health insurance works in the USA. Health insurance is a contract where you pay a monthly premium, and the insurance company helps cover medical expenses such as doctor visits, hospital stays, prescriptions, and preventive care. Most plans also include deductibles, copayments, and out-of-pocket limits.

One of the most important healthcare systems in the USA is the Affordable Care Act (ACA). This law made health insurance more accessible and affordable by creating marketplaces where individuals can compare and purchase insurance plans. It also prevents insurers from denying coverage due to pre-existing conditions.

To apply for health insurance, many people use the official marketplace HealthCare.gov. This platform allows you to compare plans based on coverage, cost, and provider networks. Applications can be completed online, by phone, or with the help of certified enrollment counselors.

Before applying, it’s important to check your eligibility. Your income, household size, state of residence, and employment status determine what type of plan or financial assistance you qualify for. Many individuals and families are eligible for premium subsidies that significantly reduce monthly costs.

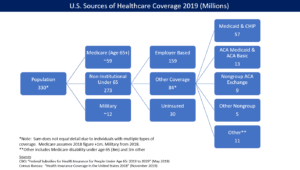

Employer-sponsored health insurance is another common option in the USA. Many companies offer health plans as part of their employee benefits package. These plans are often more affordable because employers typically pay a portion of the premium, making them a popular choice for full-time workers.

For low-income individuals and families, Medicaid provides free or low-cost health coverage. Medicaid eligibility and benefits vary by state, but it generally covers doctor visits, hospital care, maternity services, and preventive care.

Senior citizens aged 65 and older can apply for Medicare, a federal health insurance program. Medicare includes different parts that cover hospital care, medical services, prescription drugs, and optional supplemental coverage.

When applying for health insurance, you’ll need to prepare required documents. These typically include proof of income, Social Security number, immigration status (if applicable), and current health coverage details. Having documents ready speeds up the application process.

Understanding open enrollment periods is crucial. Most people can only enroll in or change health insurance plans during specific times of the year. However, special enrollment periods may apply if you experience life events such as marriage, job loss, childbirth, or relocation.

One major benefit of health insurance is access to preventive care. Most plans cover routine checkups, vaccinations, screenings, and annual wellness visits at no additional cost. Preventive care helps detect health issues early and reduces long-term medical expenses.

Health insurance also provides financial protection during emergencies. Hospitalizations, surgeries, and emergency room visits can cost thousands of dollars. Insurance ensures that a large portion of these expenses is covered, protecting you from unexpected medical debt.

Another important benefit is coverage for prescription medications. Many health insurance plans include prescription drug benefits, making essential medicines more affordable and accessible for chronic or acute conditions.

Mental health and wellness services are also covered under most modern health insurance plans. This includes therapy, counseling, and substance abuse treatment, recognizing mental health as an essential part of overall well-being.

Health insurance offers network-based care, meaning you have access to a list of approved doctors, hospitals, and specialists. Staying within the network helps reduce out-of-pocket costs while ensuring quality medical services.

Families benefit greatly from health insurance through maternity, pediatric, and child healthcare coverage. Services such as prenatal care, childbirth, vaccinations, and pediatric checkups are typically included in comprehensive plans.

Another advantage is out-of-pocket maximum protection. Once you reach a certain spending limit in a year, your insurance covers 100% of eligible medical expenses, providing peace of mind during serious illnesses.

For international residents, students, and temporary workers, special short-term or private insurance plans are available. These plans help meet visa requirements and provide basic medical coverage while living in the USA.

Choosing the right health insurance plan requires comparing premiums, deductibles, coverage limits, and provider networks. Selecting a plan that matches your medical needs and budget ensures maximum benefit.

In conclusion, applying for health insurance in the USA is a vital step toward securing your health and financial stability. Whether through an employer, government program, or marketplace, having health insurance ensures access to quality care, protection from high medical costs, and peace of mind for you and your family.